-

Life Insurance Funds a Buy-Sell Agreement

Posted on March 16, 2016 by Administrator in Breaking News, Insurance ArticlesOne of the most common ways that life insurance is being used for businesses these days is to fund a Buy-Sell Agreement. When there are multiple owners, a Buy-Sell Agreement is usually in place to provide for the transition of each person’s interest in the event of death of one of the owners. This is […]

Comments Off on Life Insurance Funds a Buy-Sell Agreement Continue Reading... -

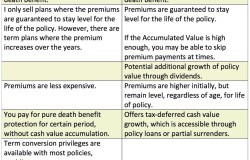

A Closer Look at Term vs. Permanent Life Insurance

Posted on March 1, 2016 by Administrator in UncategorizedThere are many factors to take into consideration when thinking about the best life-insurance coverage for you and your family. We generally like to look at your total financial landscape, taking into consideration debts and assets, age, profession, earning potential and family responsibilities. Something else to consider is whether term or permanent, also called whole […]

Comments Off on A Closer Look at Term vs. Permanent Life Insurance Continue Reading... -

Thinking about Life Insurance? 5 Common Mistakes

Posted on February 16, 2016 by Administrator in Breaking News, Insurance ArticlesDo you need life insurance? The answer is simple. If someone will suffer financially when you die, you need life insurance. The more important question: how much? You may already have life insurance through your employer, but there’s a good chance it’s not enough. Just as you have a savings account, a 401k, a college […]

Comments Off on Thinking about Life Insurance? 5 Common Mistakes Continue Reading... -

Life Insurance: Who Needs It?

Posted on January 26, 2016 by Administrator in Insurance ArticlesWhether we admit it or not, we all make New Year’s resolutions. We may not call them resolutions, and we may keep them to ourselves, but I think we all start the year with a renewed commitment to things like healthier living, getting more exercise or spending more time with our families. Apparently many people […]

Comments Off on Life Insurance: Who Needs It? Continue Reading... -

LTC Hybrid Products Provide Attractive New Options

Posted on January 13, 2016 by Administrator in Insurance ArticlesSome consider the cost of long-term care insurance to be high, and many people are reluctant to pay premiums for something they may never use. Yet the need has never been greater, and insurance companies are responding with creative new hybrid products–combining long-term care insurance with either a life insurance policy or an annuity. What […]

Comments Off on LTC Hybrid Products Provide Attractive New Options Continue Reading... -

Caring for Aging Parents Becomes Campaign 2016 Issue

Posted on December 9, 2015 by Administrator in UncategorizedThey’re calling them America’s “invisible workforce”—and you likely know at least one of them. They’re family caregivers, people who may have demanding careers, forced to put them on hold to care for ailing, aging parents or other family members. The caregiver role may not be a full-time job, and it may be shared with another […]

Comments Off on Caring for Aging Parents Becomes Campaign 2016 Issue Continue Reading... -

10 Things to Do When Choosing a Health Plan for 2016

Posted on November 4, 2015 by Administrator in Breaking News, Insurance ArticlesOpen enrollment for individual plans kicked off Nov. 1, and you need to choose a plan by Dec. 15 if you want coverage to take effect Jan. 1. If you don’t choose a new plan, your existing plan may continue your coverage, but don’t assume that will happen because not all plans continue. Confirm that […]

Comments Off on 10 Things to Do When Choosing a Health Plan for 2016 Continue Reading... -

The MythBuster: 4 Myths about Disability Insurance

Posted on October 21, 2015 by Administrator in Breaking News, Insurance ArticlesThere’s a huge disconnect when it comes to understanding disability insurance. As an insurance broker, I find that my clients are often the victims of second-hand information from people who have not stayed on top of a rapidly changing industry and hearsay. Myth No. 1: The odds of experiencing a disability […]

Comments Off on The MythBuster: 4 Myths about Disability Insurance Continue Reading... -

ACA’s Preventive Services with No Co-Pay

Posted on October 16, 2015 by Administrator in Insurance ArticlesACA’s Preventive Services with No Co-Pay A key provision of the ACA is the requirement that it provides certain recommended preventive care services at no additional cost to patients—that means no cost-sharing or co-pay. Research shows that preventive care saves lives and improves health by identifying illnesses earlier, when they are still treatable and manageable. […]

Comments Off on ACA’s Preventive Services with No Co-Pay Continue Reading...